Benefits of Number Pooling for Insurance Carriers

Rocco Neglia, Vice President, Claims and Loss Prevention, Heartland Farm Mutual, said, “Hi Marley is solely focused on the insurance industry. They are knowledgeable of the problems unique to insurance and are dedicated to solving them.” For example, we’ve seen certain challenges arise when carriers implement direct line assignments (DLA) or direct inward dialing (DID) to text enable current adjuster phone numbers. Hi Marley supports 10 Digit Long Code (10 DLC) or Number Pooling (NP) for messaging, which has many benefits for insurance carriers.

What is DLA vs. Number Pooling?

Direct Line Assignment or Direct Inward Dialing are phone numbers that route inbound calls/texts directly to specific contact or location within an organization; rather than going through a menu or requiring an extension. NP is tied to an organization instead of an individual person. NP uses one number that can support high volumes of messages. Inbound requests can be seamlessly transferred from person to person in the organization without interruption to the inbound user.

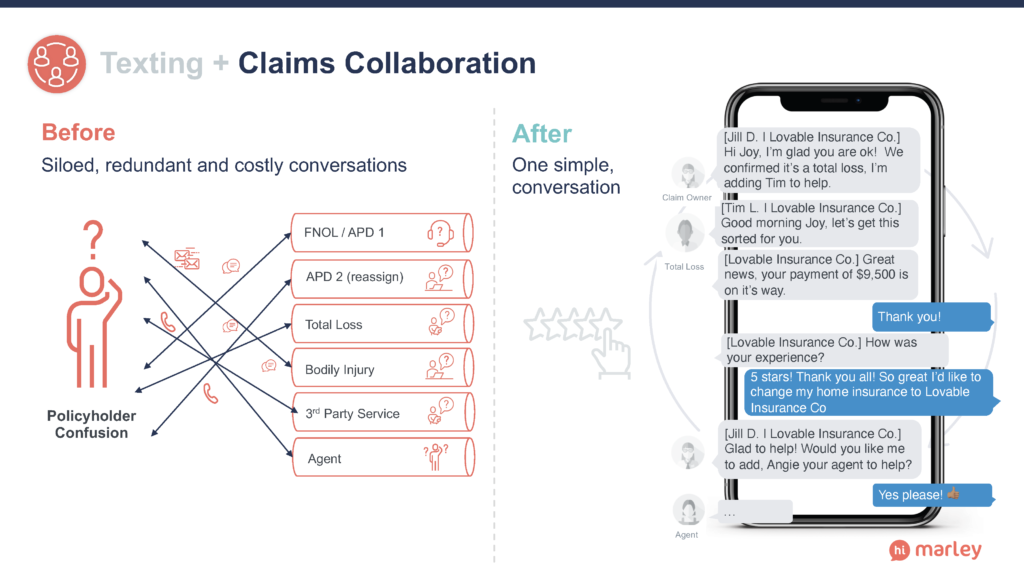

Support for Multi-Adjuster Models

The biggest benefit of NP is in multi-adjuster models; DLA/DID creates a lot of customer confusion when a supervisor needs to check in on an out-of-office adjuster’s conversation or uses round-robin assignments, team call handling and first available strategies.

On the other hand, NP allows all carrier employees and contractors assigned to the claim to reach out to the customer using the same number.

Reduces Risk and Compliance Cost

Claims admin systems need a lot of logic to determine what texts on the adjuster number belong to what claims in a DLA/DID model. DLA interactions provide fragmented transcript history if the carrier is piecing together multiple contact experiences.

With Hi Marley, the NP methodology tightly couples the conversation to a specific claim where a new phone number is used for each new claim. This way ensures carriers can easily integrate records upload to always have a compliant record in their core system, reducing risk and integration costs. “I look at the reduced cost as reduced compliance risk,” said Jason Bidinger, Claims Process Leader, Westfield Insurance. “By automating the transcript process, we’ve eliminated the risk of lingering text conversations outside of our file.”

Directs Inbound to Proper Resources/Teams with Ease

Suppose a policyholder has an unrelated question six months after their first interaction with the carrier. In that case, they might text the DLA/DID number thinking it was a universal rep for claims and service. This model interrupts the representative who previously supported the customer only to have that call transferred or rerouted to the correct channel.

With NP, carriers can direct inbound messages and reassign that conversation cross-functionally with ease, moving the customer to the correct queue and proper resources or teams to resolve the issue.

Customers are no longer put on hold or stuck waiting for a callback. Carriers can seamlessly transfer the request to the correct queue on the back end without any required action from the customer, leaving their experience uninterrupted. Knowing that 84% of people said they would save an insurance text number to their contacts, this functionality both enhances efficiencies and increases customer satisfaction.

While NP is intentional for cross-collaboration throughout the claim, should the end-user need to directly contact the adjuster via phone, they will receive a direct contact phone number during the opt-in flow of the welcome message.

Streamline Communications

Policyholders expect fast service and responsive insurance representatives. In Hi Marley’s consumer survey, 50 percent of respondents selected speed of response or 24/7 availability as the most important expectation for texting with an insurance company. Overall, NP supports faster messaging and better deliverability.

DLA is also not a supported feature for contact centers, inbound, or notification use cases at insurance carriers. Insurance claims can include several parties, and NP aligns much better with best-in-class workforce management tools that currently support insurance carrier contact and support centers. “The Hi Marley team is deeply knowledgeable of – and focused on – the insurance ecosystem, which streamlines every conversation,” said Steve Messina, Senior Vice President of Insurance Operations at Bankers Insurance.

Furthermore, connecting to automation, straight-through process workflows, assignments, and routing workflows to DLA is very complicated. Operator admin like out-of-office notifications and automatic expectation alerts are more complex with a full DLA model. NP limits those complications, and that’s why Hi Marley supports this model.

Hi Marley is the only communication platform built for insurance, so we know the specific technology issues carriers face and provide integration best practices from our experience to help our customers receive the greatest ROI. “We chose to partner with Hi Marley primarily because the team understood insurance,” said Jon Perkins, Claims Manager, Merchants Insurance Group. “The competitors we met with came from banking and other non-insurance backgrounds. Hi Marley’s deep industry knowledge and experience gave them a huge advantage. We knew we could trust them as our technology partner.”

Reach out to Hugh with any questions at [email protected] and stay tuned for more blogs in the future on this topic!