FNOL Sets the Tone for the Entire Claims Process

FNOL is perhaps the most critical moment of truth for insurance. However, challenges posed by current intake channels cause disruption for carriers and insureds. Customers want to call, but long FNOL phone conversations are costly for carriers and require manual information gathering without an effective way to automate claim capture. Confusion, frustration, inaccurate assignments and inefficient, repetitive workflows cause cycle time delays and poor customer experiences. Carriers need a more advanced FNOL solution that simplifies every step of the process and meets policyholders where they are—on the phone.

Current FNOL Experiences

For Carriers

- Inefficient, expensive solutions

- Low self-service tools adoption

- Low-quality FNOL after-hours

- Poor customer experiences

For Policyholders

- Repetitive storytelling

- Disjointed communication channels

- Barriers to self-service

- Long wait times calling in

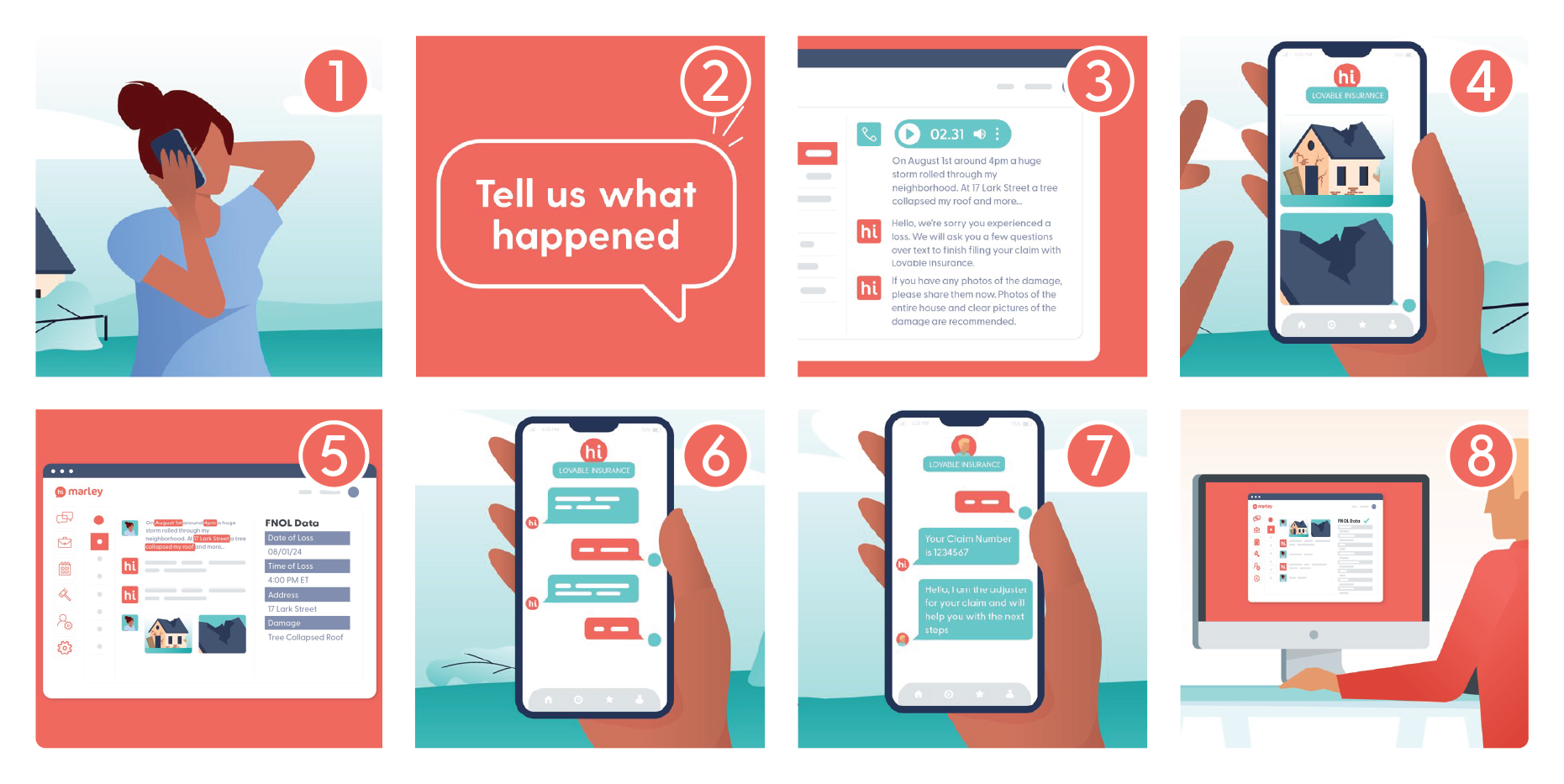

The Solution: Hi Marley’s Conversational FNOL™

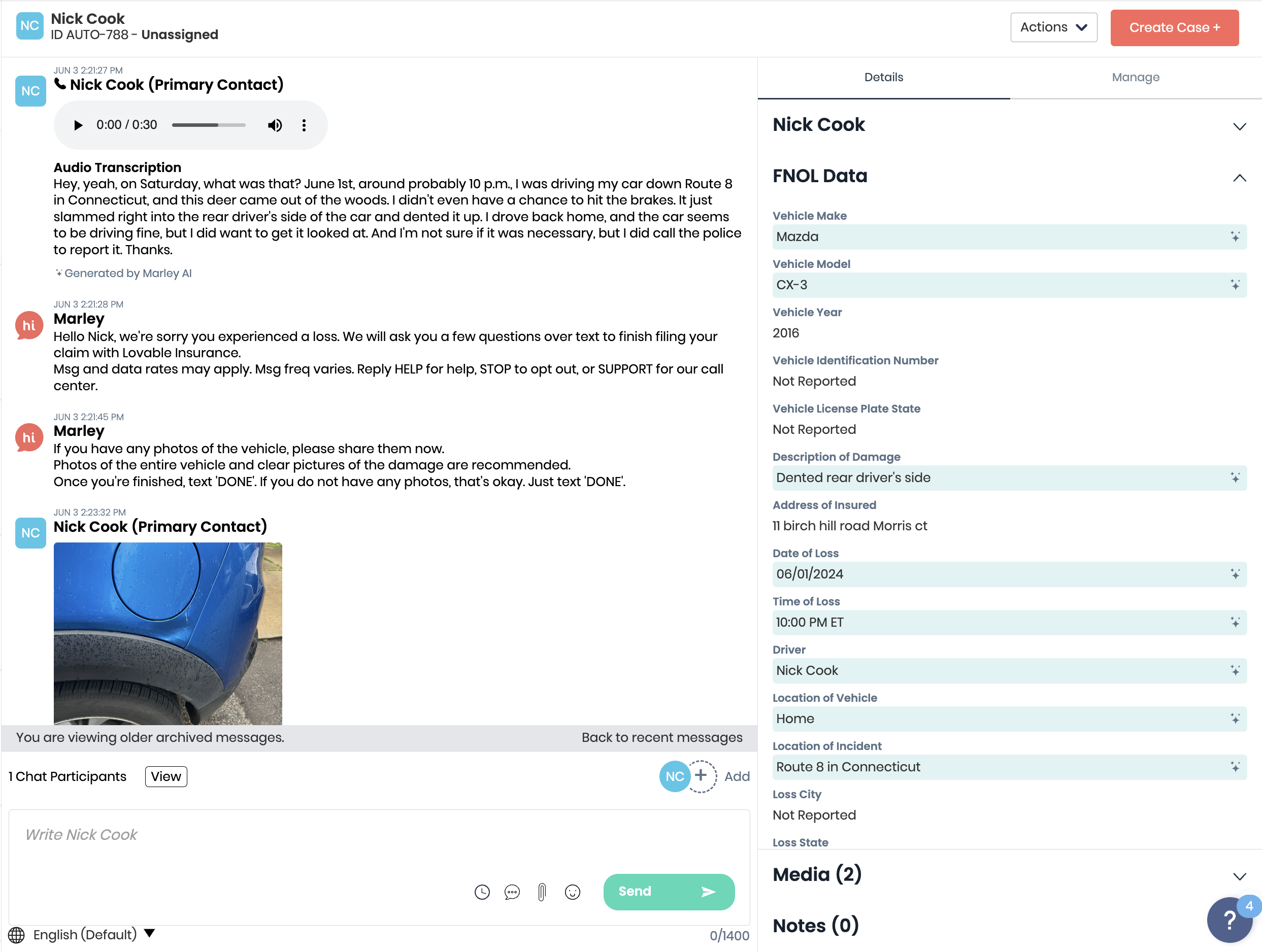

Built for insurance, Hi Marley’s Conversational FNOL provides a natural extension of the phone experience.

Customers explain what happened in their own words and carriers gather critical information immediately. Any operator assigned to the Hi Marley case can access and reference the customer stories and data throughout the claim lifecycle.

Natural (and Fast) FNOL Capture

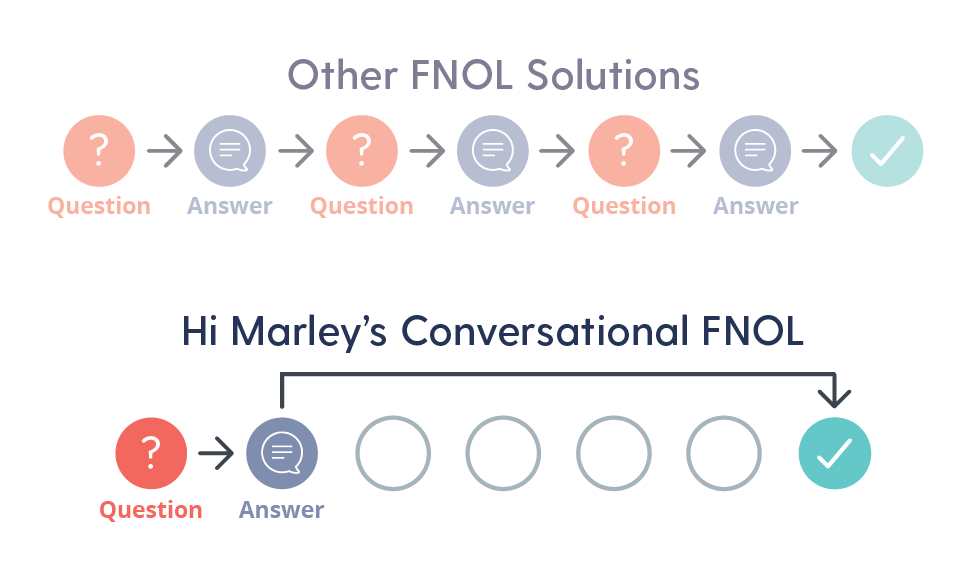

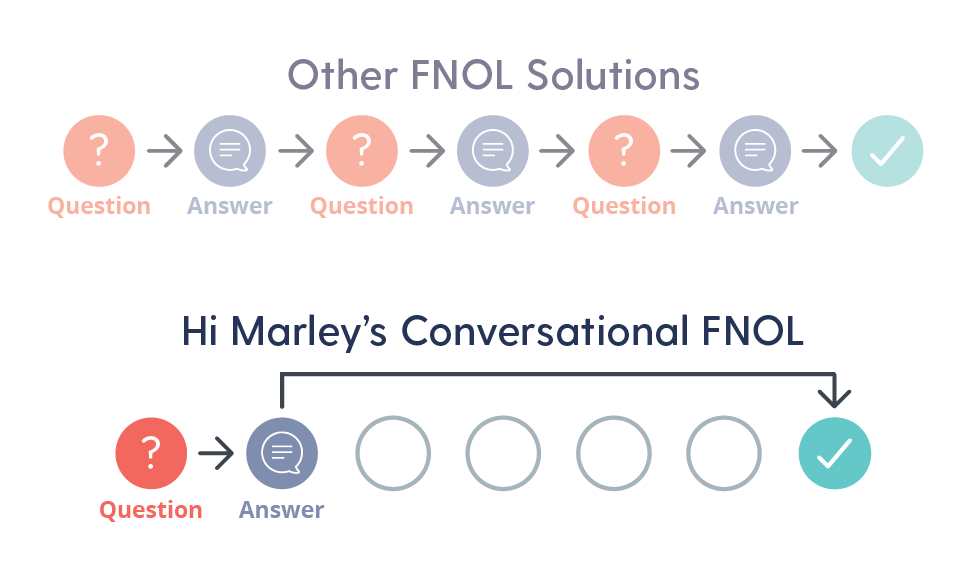

Hi Marley’s Conversational FNOL encourages policyholders to describe what happened in their own words right away, rather than enter a prescribed question-and-answer style, form-based workflow.